This short mini-essay is the second in a five part series which suggests that our banking system is due for a collapse. And since that system is originally of Renaissance-vintage, we could be in for a Renaissance-like transition. There are some interesting historical symmetries to buttress the point, and it has an optimistic outlook overall. Read it to find out more!

Collapse is coming; we’ve hitched our economic wagons up to an infinite growth engine and growth has already stalled. A nexus of bankers and financiers lurks at the core of our economy, like fat spiders in the center of a giant web. They control a vast pool of investment dollars chasing a return, loaning or investing when they think they can ultimately collect more dollars back than they’ve paid in. And they often throw those returns right back into the pool to chase even more returns, constantly swelling in size. Only an infinitely-growing economy could accommodate an infinitely-growing pool of investment capital.

But infinite growth isn’t possible within a finite system. As the saying goes, that’s the logic of a cancer cell. There are only so many goods and services that we can cram down each other’s throats every year. It’s unrealistic to expect an endless parade of new businesses, each capable of supporting investors. And yet our system has evolved with exactly this expectation baked right into it.

From the World Economic Forum

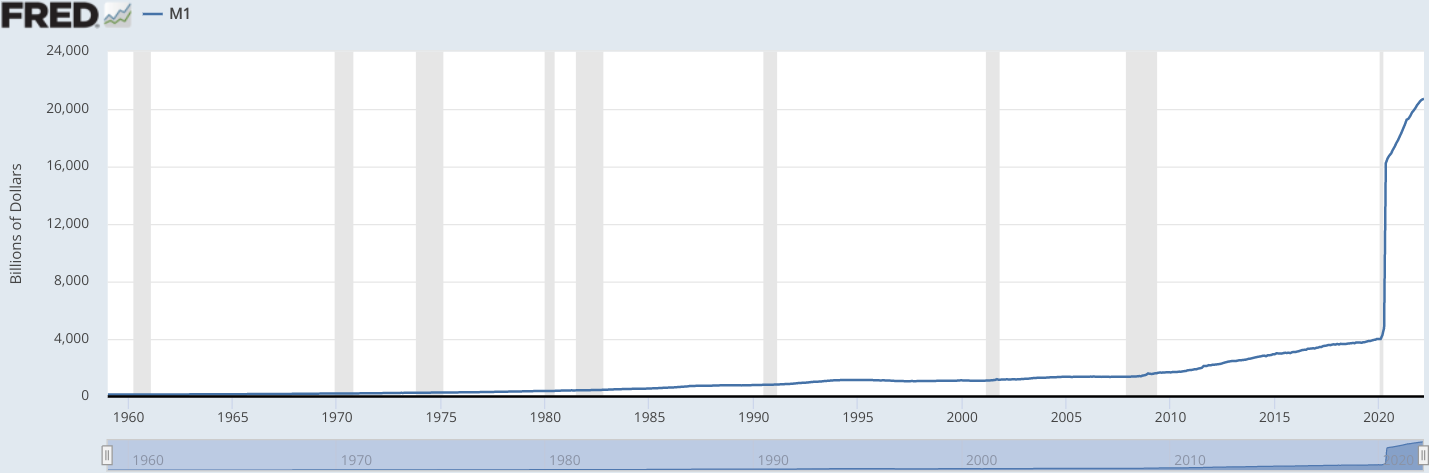

To meet this impossible expectation, we’ve been printing crazy amounts of money in a futile bid to artificially pump up growth. If we stuff bank vaults full of dollars, goes the thinking, then the banks will locate more credit-worthy entrepreneurs to gin up those desperately-needed businesses. But of course, it hasn’t happened. We’ve only expanded that already-swollen pool of investment dollars, without mustering much in the way of actual economic activity at all. All that extra money has just served to inflate asset prices, like homes or stocks.

Dollars in Existence, from the Federal Reserve

The signs of mounting chaos are everywhere. As the clock ticks, it’s no longer remotely controversial to suggest that a monster economic collapse is in the offing. Accordingly, we'll leave any more specific mechanics of collapse for another essay series. It's enough for now just to note that this banking system undergirds our entire economy, and that it can't survive the introduction of 80% of the world's dollars in just the past two years, as shown on the chart above. The conductor is tapping the baton and rousing the orchestra…the real chaos is about to begin.

Stay tuned for tomorrow’s sequel, where we will place the upcoming collapse in a broader historical context.